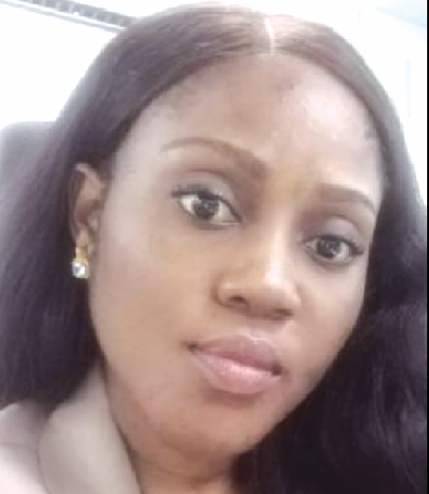

Challenges Are Not Stumbling Blocks But Learning Points – Barbra Obika-Anioke, General Counsel, Veritas Registrars

Can we have an insight into your background and profile?

I am a qualified legal practitioner of the Supreme Court of Nigeria and a graduate of Law from the University of Benin with over 13 years post-call experience.

I am also a Designate Compliance Professional of the Compliance Institute of Nigeria, CIN, and licensed with Securities and Exchange Commission as a capital market operator as Compliance Officer. I am married with children and from Delta State – Agbor.

Can you take us through your career trajectory?

My NYSC place of primary assignment was with the Ministry of Justice, Enugu State where I was involved in legal drafting. Prior to that, I had my compulsory chamber attachment, a prerequisite for all aspiring lawyers in Edo state.

Presently, I work in Veritas Registrars Limited in the Compliance Unit, while also providing legal advice concerning the organization’s business. Prior to joining Veritas Registrars Limited, I had garnered extensive experience as an officer in the Compliance Department of Zenith Bank Plc.

Beyond paid employment, I also offer pro bono services as an adviser/consultant to several Non-Governmental Organisations, NGOs.

Who and who would you say have been most influential on your life and career?

Generally, my mother has been a constant propelling force for me. I admire her resilience and never-say-die attitude. Professionally, I must admit that I have been lucky to work with different bosses who have impacted me positively and made me a better version of myself. It would be unfair of me to single out a single individual in this regard.

As a woman, what are the challenges you have encountered in the course of your professional journey and how did you tackle them?

The challenges often are in the region of stereotypes as to what a woman can achieve and an imaginary ceiling beyond which she cannot rise. In tackling them, it has also been me proving my worth on assigned tasks, delivering way above expectations and always reinforcing the phrase of “what a man can do, a woman can do (even better)”. My code to this is “show your workings” and the fact will speak for itself.

Can you relate some memorable experiences that you’ve had in your career?

This will include being a change agent in organizations I have found myself despite not being the longest on the job. A very good example is clarifying that agelong conventions/processes that have gone on for a long while without any loss crystallization are not necessarily lawful and that there is always need and avenue for change.

What are the challenges you face in the discharge of your duties and how have you been surmounting them?

The challenges I have faced mostly relate to my gender. As I have previously stated, I tackle them, by proving my worth on assigned tasks, delivering way above expectations and always reinforcing the phrase “what a man can do, a woman can do (even better)”. Challenges are not stumbling blocks but learning points.

What advise do you have for aspiring female professionals in Nigeria?

Never settle for any stereotypes concerning gender. Break through imaginary ceilings imposed and continually give your best while also improving yourself.

I Want To Position Lagos Continental As A Benchmark for Service Excellence In West Africa – Caroline Wilson-Obasa, Asst. Director, Sales & Marketing

From the outset, Caroline Wilson–Obasa knew what she wanted career-wise, so she didn’t waste her time perambulating on the profession suited for her. Thus, after her secondary education, she went straight to read Hospitality Management at the Yaba College of Technology, and immediately afterwards, joined the hospitality industry.

Over the years, she has had the opportunity to work in various dynamic environments in the industry. Today, she is the Assistant Director, Sales and Marketing at the prestigious Lagos Continental Hotel. “My journey has been one of continuous learning, relationship building and pushing myself to grow professionally and personally”, she asserted.

Starting off her career at Four Points by Sheraton and later joining Marriot Hotel, she was part of the pre-opening team at the latter hotel. A stand-out woman, she has gained considerable exposure in corporate sales, marketing, and strategic planning over the years and grew through the ranks by consistently delivering results and developing strong client relationships.

Said she: “My current role as Assistant Director of Sales and Marketing at Lagos Continental has been one of the most rewarding yet, it allows me to lead strategy, mentor a team, and contribute to the hotel’s overall growth. My role is multi- faceted. It oversees sales across segments, corporate, MICE, and leisure, and drives marketing initiatives that boost brand visibility and bookings. I collaborate closely with revenue management, conference and events, and operations to ensures our efforts are aligned with business goals. It is a mix of strategy creativity and constant client engagement.”

Caroline whose background is rooted in resilience, determination, and hardwork pointed out that her mother is the person she tries to emulate everyday because she is an embodiment of these qualities.

Her professional mentoring however came from leaders who believed in her even when she doubted herself. Their encouragement and inspiration was what helped shape her work ethic and confidence, she revealed.

As a woman, it is not unusual to have experienced some biases and male chauvinisms in her professional journey. She declared: “One of the key challenges has been breaking through the stereotype of females working in the hotel industry. Early on, I had to prove myself to be taken seriously repeatedly. I tackled this by staying professional and letting my results speak louder than anything else. I also learned the importance of setting boundaries, asserting my voice, and building a network of strong female professionals who share knowledge and support each other.”

But though there are downsides, Caroline has had many memorable experiences in her career journey. One that particularly stands out, she says, was leading a sales turnaround project during a challenging period. It is noteworthy that her team met and exceeded revenue goals, and of course, got recognized and rewarded for it.

Speaking about her achievements in her current role, she declared that she has led several successful campaigns which directly impacted revenue. For instance, corporate room average rate has been increased by 42% year on year just as direct bookings have been boosted through digital optimization while team training has equally been well developed to enhance productivity.

Her primary goal for the hotel is to strengthen its market leadership and make it the first choice for corporate and leisure travelers. “That involves deepening client relationships, driving innovation in our campaigns, and developing our sales team to deliver consistently at the highest level. In the long term, I’d like to position Lagos Continental as a benchmark for service excellence in West Africa and beyond and be a key player in showcasing tourism in Nigeria,” she maintained.

To aspiring female professionals, she enjoins them to believe in themselves, own their voices, seek mentors and not to shy away from opportunities that stretch them. Most importantly, she urged them to remember that leadership is about influence, integrity, as well as impact, and not about title.

Banking Allows Me To Combine My Technical Knowledge With Strategic Business Development – Catherine Vincent-Udensi, Country Head, Capital Market Products & Solutions, Nigeria & WA, Standard Chartered Bank

Can we have an insight into your background and profile?

I am a seasoned financial services executive with over 20 years of cross-functional experience across Retail Banking, Corporate Banking, Financial Markets, and Wealth Management.

My academic foundation includes a B.Sc. in Insurance and a Diploma in Accounting from the University of Lagos, as well as an MBA from Lincoln University, California, USA. I am a Chartered Insurer and a member of the Chartered Institute of Bankers of Nigeria CIBN. I am also a member of the Chartered Insurance Institute of Nigeria, CIIN.

In addition, I hold certifications in Treasury Markets, ACI; Product Management, PMP; and Wealth Management, CISI; and I am currently a Fellow of the Nigerian Institute of Credit Administration, FICA.

Presently, I serve as the Country Head of Capital Market Products and Solutions in Nigeria and West Africa at Standard Chartered Bank. In this role, I lead strategic initiatives that drive product innovation, revenue growth, and client engagement across diverse market segments.

My career has been shaped by a passion for value creation, strategic innovation, and inclusive leadership. I am deeply committed to empowering teams and clients to achieve sustainable financial growth, while fostering a culture of integrity, excellence, and impact.

You read Insurance and are also a Chartered Insurer. Why did you choose banking over insurance as a profession?

While my academic foundation in Insurance gave me a deep understanding of risk and financial planning, I found myself drawn to the broader, faster-paced world of banking where I could explore a more diverse range of financial solutions and directly engage with market dynamics.

Banking allowed me to combine my technical knowledge with strategic business development, client engagement, and financial markets exposure — providing a more expansive platform to innovate, lead, and create impact.

Can you take us through your career trajectory?

I began my career in the banking sector as a Customer Service Officer at Zenith Bank, where my strong performance and aptitude for client engagement led to a swift transition into sales—covering both retail and commercial banking. This early success laid the foundation for my journey in Retail Banking, from where I joined Standard Chartered Bank as a Personal Financial Manager.

I progressed to become Regional Head of Priority Banking, overseeing high-value client relationships and driving performance across multiple teams. My career then evolved into Corporate Banking, where I served as a Senior Client Manager, managing strategic relationships with large corporates and deepening my exposure to complex financial solutions.

Driven by a passion for markets and innovation, I transitioned into Financial Markets, starting with Corporate Sales, and later ventured into Retail Treasury Markets, focusing on Foreign Exchange, Fixed Income Products, and Treasury Solutions for individual and institutional clients.

Over the years, I have held key leadership roles spanning product development, wealth management, and client solutions. Today, as Country Head for Capital Market Products and Solutions for West Africa at Standard Chartered Bank, I oversee a diverse portfolio that includes Foreign Exchange, Fixed Income, Structured Products, and Wealth Lending.

I work closely with Relationship Managers, Sales Heads, and client-facing teams across the region to drive performance, innovation, and sustainable financial growth.

Who would you say have been most influential on your life and career?

My parents laid the foundation of discipline, hard work, and faith that continues to guide me today. My man of God, Rev. Dr. Chris Oyakhilome, Dsc; D.D, has been a spiritual compass and a constant source of inspiration, shaping my outlook on purpose, leadership, and impact.

I’m also deeply grateful to my mentors, whose guidance helped me navigate key career decisions and transition into strategic leadership roles.

As a woman, what are the challenges you have encountered in the course of your professional journey and how did you tackle them?

As a woman in a traditionally male-dominated industry, I’ve had to consistently demonstrate competence, resilience, and confidence. Early in my career, I faced moments where my ideas were second-guessed or overlooked.

Rather than retreat, I chose to let my results speak. I invested in my growth, took on challenging assignments, and built alliances across the business. I also learned to own my voice and bring others along, mentoring younger women and advocating for inclusion and representation at the table.

Can you relate some memorable experiences that you have had in your career?

One of the most memorable moments in my career was leading a turnaround initiative that repositioned our investment solutions within the Retail Banking segment for significant growth.

Despite prevailing economic headwinds, my team and I successfully delivered bespoke, client-centric products, surpassed our targets, and expanded our client base, reinforcing the bank’s value proposition in the market.

Another standout moment was being invited to speak at a regional strategy conference, where I presented innovative ideas on product delivery and market penetration.

To my delight, several of those ideas were adopted across the wider organization, marking a defining point in my journey as a thought leader within the bank.

More recently, being selected by The Guardian as one of the 25 exceptional and most value-adding female professionals is a deeply humbling milestone—one that affirms the impact of years of dedication, resilience, and passion for excellence. It’s a moment I will always cherish.

You are the Country Head for Capital Market Products and Solutions at SCB. What does your work entail?

In my current role as Country Head of Capital Market Products and Solutions for West Africa, I lead the design and execution of capital market offerings tailored to meet the evolving needs of our clients. This includes a broad suite of products such as Foreign Exchange, Fixed Income, Wealth Lending, and Investment Solutions.

I work closely with a wide network of stakeholders—Business Heads, Relationship Managers, Investment Advisory Teams, Senior Stakeholders in Operations, and Risk Partners—to deliver bespoke, client-centric solutions that are both strategically aligned and regulatory-compliant.

It’s a highly dynamic role that requires agility, foresight, and a deep understanding of global and local market trends. My focus remains on creating value, driving innovation, and positioning our clients for long-term financial success in an ever-evolving economic landscape.

What has been your achievement in this role?

Under my leadership, we’ve consistently exceeded set targets, introduced innovative products and solutions, and deepened our market share in strategic segments. I led the successful integration of Capital Market Solutions with our Wealth and Retail offerings, which significantly improved cross-sell and client retention.

We’ve also enhanced our client engagement models, empowered Relationship Managers through training and tools, and laid the groundwork for long-term growth across the region.

What are the challenges you face in the discharge of your duties and how have you been surmounting them?

Navigating market volatility, regulatory changes, and shifting client expectations are some of the key challenges. I’ve tackled these by staying close to market intelligence, fostering strong internal collaboration, and remaining adaptable.

Another challenge is talent retention and skills development, which I’ve addressed by championing mentorship, continuous learning, and clear career pathways within the team.

What are your aspirations for your department?

I envision a world-class Capital Market Solutions team that is digitally driven, client-centric, and anchored on innovation. My goal is to build a scalable, future-ready platform that consistently delivers sustainable value across our markets, while also nurturing and empowering the next generation of leaders within the business.

Beyond business performance, I am passionate about driving financial inclusion by democratizing access to investment products and solutions, particularly for emerging and underserved client segments.

I believe that with the right tools, education, and access, more individuals and businesses can participate meaningfully in the financial markets—and that’s a vision worth pursuing.

What advice do you have for aspiring female professionals in Nigeria?

Believe in your worth, invest in your growth, and stay true to your values. The path may not always be easy, but your consistency, character, and courage will open doors.

Surround yourself with mentors and allies who challenge and uplift you. And remember — leadership isn’t just about titles, it’s about impact. So wherever you are, lead with excellence, compassion, and purpose.

My Primary Goal Is To Ensure Impactful Strategy Execution At Beacon Power Services — Christine Adejorooluwa, Chief Strategy Officer

Can we have an insight into your background?

I am the last of four children, raised in a family that instilled strong values of discipline, education, and integrity. I obtained a First-Class Honours degree in Mathematics with Management from the University of Leicester and later earned a Master’s degree in Strategy and International Business from Aston University.

My upbringing and education shaped my analytical mindset and passion for developing solutions that create meaningful impact, particularly across Africa.

Can you take us through your career trajectory?

My career began at Rosabon Financial Services, where I served as Lead Operations Specialist. There, I was responsible for optimising internal processes and establishing new departmental policies that improved efficiency across teams.

I then joined KPMG Nigeria, where I was privileged to work on strategy development, public sector reform, and large-scale advisory projects that exposed me to key decision-makers in both the public and private sectors.

After KPMG, I transitioned into commercial strategy roles—first at Mixta Africa and then at MVX. These roles deepened my experience in investor relations, strategic partnerships, and market expansion across African markets.

Today, I serve as Chief Strategy Officer at Beacon Power Services, BPS, where I lead strategic planning, investor relations, ESG initiatives, and corporate communications for a fast-growing energy-tech company focused on transforming electricity distribution across Africa.

Who and who would you say have been most influential on your life and career?

My mother has been the most influential figure in my life—her strength, faith, and persistence taught me the value of grace under pressure. Professionally, I’ve had the privilege of working with bold and visionary leaders who encouraged me to think expansively and act decisively. I also draw inspiration from women in leadership who challenge norms and create room for others to rise.

Can you relate some memorable experiences that you’ve had in the course of your career?

One of the most memorable moments was participating in the strategic implementation of a regulation that significantly benefited a multinational client. My role involved conducting an economic impact assessment of both the company and the broader industry—a complex but rewarding assignment.

Another highlight was supporting the facilitation of the 2019 Induction Retreat for Incoming Ministers, where I helped develop strategic imperatives for key sectors, including Power, Transportation, Agriculture, and Healthcare. It was an opportunity to directly contribute to shaping national policy.

You are the Chief Strategy Officer for Beacon Power Services, what does the company do, and what does your work entail?

Beacon Power Services provides data and technology solutions that help electricity distribution companies in Africa improve reliability, customer experience, and revenue. Our platforms—CAIMS and Adora—enable utilities to manage their assets, customers, and collections more effectively.

As Chief Strategy Officer, I lead strategic planning, investor relations, and Environmental, Social, and Governance (ESG) efforts. I also oversee our marketing and communications function, ensuring that our brand positioning accurately reflects the impact we deliver across Africa’s power sector. My role involves working closely with leadership to shape the company’s long-term direction and influence how we tell our story.

In what ways would you say you have been impacting and adding value to the company?

I’ve contributed to BPS’s growth by refining our strategic direction and ensuring organisational alignment around our vision. I have led efforts to position BPS as a recognised name in the energy-tech space, building brand equity across key African markets.

I’ve also worked to track and communicate our impact through the use of data and storytelling, making it easier to show the value we create for utilities and their customers. In addition, I’ve enhanced investor engagement, strengthened our ESG positioning, and contributed to more structured internal operations through strategy enablement.

What are your goals for your directorate?

My primary goal is to ensure seamless and impactful strategy execution. This includes translating our ambitious vision into actionable roadmaps and ensuring our ESG, marketing, and communications functions reinforce that vision at every level.

I am also focused on expanding our strategic footprint across Africa by unlocking new market opportunities and building stronger stakeholder engagement frameworks.

Over the next year, I intend to enhance how we measure and communicate impact, not only to investors but also to the communities we serve. Ultimately, I aim for my Directorate to be a center of clarity and forward momentum within BPS, proactively shaping the company’s growth and long-term relevance in Africa’s power sector.

What advice do you have for aspiring female professionals?

Be unapologetic about your ambition. Your voice, ideas, and leadership matter—own them. Be intentional about building your skills, finding mentors, and nurturing relationships. Do not let imposter syndrome hold you back; instead, trust the value you bring to the table. Most importantly, lift as you climb—empower other women as you rise.

My Focus Is On Helping Moneda Invest Succeed By Shaping a Culture Where Employees Can Thrive and Deliver Results – Ebi Sese, Director, Human Resources, Moneda Invest

Though Ebi Sese studied Telecommunications Engineering and even obtained a Master’s in Engineering Business Management, it will interest anybody to know that she is today in the human resources field. In fact, she functions as the Director of Human Resources for Moneda Invest.

“I didn’t plan a career in HR, I discovered it during my NYSC 16 Years ago, and I’ve been passionate about it ever since,” she says, adding, “I’ve worked across various industries from education to technology to oil and gas and financial services and the one and constant I’ve observed is this: people are the true engine of performance. Even the most brilliant strategy will stall without the right people in the right culture. But when you match talent with the right systems and an enabling environment, performance takes off. That is what I ‘ve committed my career to: building those conditions that unlock potential and drive results”.

She informed that her pivot into the industry began during her NYSC year at Citizen Petroleum where she served as a human resources officer. That role, she noted, was what exposed her to the power of people management and she eventually rose to become the Human Resources Manager before leaving to pursue her Master’s degree in the UK.

Upon her return, she joined the Lagos Business School from where she got a strong foundation in structured hr practices within an academic environment. From there, she moved to True Blue Energy, and later, to Cordros Capital where she served as Head of Human Resources.

Eventually, she was headhunted from there by Prophius to come and lead their human resource function as the company expanded regionally. Here, she became responsible for shaping a people strategy that was not just local, but global, that is, adopting global practices to suit our Africa context.

As the Director of Human Resources at Moneda Invest, Ebi oversees the Human Capital Office Management, Facilities and IT, ensuring that the company has the right people, processes and infrastructure to support its growth beyond Nigeria into other African markets like Namibia and South Africa.

She makes sure that the HR approach is not just functional but strategic, deeply aligned with the organization’s performance goals. “It’s a broad mandate” she stressed”, “but one that allows me to bring my full experience to bear in aligning people strategy with business performance at a Pan – African level.”

Asked of those that have been most influential on her life and career, she didn’t waste time in saying they were her parents. According to her, she has been incredibly fortunate to have them as her parents because they have always given her unwavering support throughout her journey even when it took an unexpected turn from engineering to human resources.

She explained that their faith in her has been her anchor and that she considers their support a gift which she doesn’t take for granted.

As regards the defining moments in her career, she recalled that one that really stands out was when she was thrust with a leadership role for the first time, adding that it was both exciting and daunting.

Said she: “There’s a shift that happens when you move from being an individual contributor to leading a team. Suddenly, it’s no longer just about executing tasks, it’s about setting direction, making decisions, and being accountable for both successes and failures.You realize that the performance of the team rests squarely on your shoulders. That experience taught me what it truly means to lead, not just to manage.”

In a situation where many employees are disengaged or quietly quitting, how has she been able to keep the culture alive in the firm, she was asked. Answering, she defined culture as daily actions, consistent behaviours, and the way people treat one another across all levels of the organization and that at Moneda, this is taken to heart, as culture is both friendly and performance – driven in the firm.

“Collaboration here isn’t competitive, it’s authentic. Colleagues lift each other up, celebrate wins as a team, and hold one another accountable with mutual respect. Managers lead with empathy but also with clarity – setting expectations, providing timely feedback and empowering their teams to consistently deliver results. We are intentional about creating a workplace where every voice matters, regardless of title or tenure, we invest heavily in recognition, continuous learning, and ensuring that every employee understands exactly how their role contributes to our wider organizational objectives. Our effort are paying off. Our recent employee Net Promoter Score was +85 – a strong indicator that we are not just saying we have a great culture, we are living it”, she asserted.

For her, her ultimate goal is to help Moneda succeed, not just by hiring great people, but by shaping a culture and structure where they can thrive and deliver results.

Our Goal Is To Take Many People Off The Streets – Esohe Aihor, Head, PGCSF, Poise Nigeria

She has not failed to continuously display sterling qualities of dynamism, organization, problem solving, analytical thinking and purposeful leadership. So, she is result – oriented in a manner that has become an obsession. It is however certain that her academic background combined with her professional expertise is what has positioned her to be a driver of impactful initiatives.

She is Esohe Aihor, the Head of Poise Graduate Communal Support Foundation, a subsidiary of Poise Nigeria. A position she has held since mid – 2020, Esohe who holds an LL.B from Benson Idahosa University, and LL.M from the University of Hertfordshire had worked as a legal associate at Quebec Attorneys prior to this. Besides her law degrees, she also possesses certification in NGO Management from Lagos Business School.

A professional whom hard work and excellence had always been a watchword, Esohe reveals that she took these from her parents. “My work ethics today comes from my parents”, she noted. “My dad, an engineer, was always first to get to work and last to close. My mum too, when she started her business – you’ll think she would be slack, but no. That was when she even worked harder than anyone could imagine, and I have a sister too who is equally hard working. It’s like the hard work spirit is embedded in us. So, my parents have been the most influential people on my life and career.”

Her passion for defending people and standing for justice right from youth was the reason she went on to read Law. However, she believes what she is doing now, heading a foundation, is an extension of that passion.

Lest we forget, Poise Graduate Communal Support Foundation is an organization set up to tackle poverty and reduce unemployment by equipping teenagers and youths from underserved communities, and youths who are unable to further their education due to circumstances beyond their control with global technology skills as well as soft skills so that they can be able to earn a living and meaningfully contribute to Nigeria’s economic growth.

“Our goal is to re-engineer the nation’s work force”, Esohe says. “We do this by bridging the gap between the knowledge gotten from formal education and what is required for success in life. We focus on upskilling youths who are socially and economically disadvantaged. We are improving the nation’s GDP one individual at a time as graduates of our programmes record employment rate of 80%.”

On the challenges being faced, she said getting people to buy into the idea of what they are doing is very difficult. “It surprises me that people can cough up to 20 million naira to throw a party, but can’t bring out 10 million naira to help getting a life off the street. We need to redirect our priorities because I tell people that if any class uprising breaks out, we the middle class will be the first to suffer attacks before it gets to the 1% elite class. We need to understand that.”

And talking about memorable experiences, she hinted that there have been many but that the most indelible ones are the joy on the faces of the children they have been able to take off the streets on their graduation day. In fact, she noted, her foundation always does “before – and – after pictures”.

“When you see their pictures before they started, and their pictures after, you will marvel. Also, as you notice the appreciation, the joy in their faces, the excitement, you will be happy too. Most of them go on to live decent lives, in fact earning in dollars. Even, one of them is ready to sponsor others now”, she revealed.

She further revealed that each time she sees these people they trained looking radiant, comfortable, and living better lives she is always overjoyed. Esohe disclosed that they will soon be coming up with a YouTube channel called Shadow of Society. And to other women out there, she enjoins them to stop trying to compete with the men advising them to rather focus on their strengths.

She doesn’t believe her foundation has achieved yet. This, she says, is because they have not been able to remove their desired number of people from the streets, and until they are able to do so, she says she cannot gloat yet.

I Am Enthusiastic About Unlocking Capital For Africa Businesses – Nkechi Amangbo, VP, Moneda Invest

Can we have an insight into your background and profile?

I am a finance and investment professional with over a decade of expertise across banking, commodity trading, and structured finance. I currently serve as the Vice President, Liquidity, Commodities and Global Markets at Moneda Investment Limited and the Managing Director of Domena Commodities.

I am enthusiastic about unlocking capital for African businesses, particularly those in energies, agriculture, and extractives, and I am deeply committed to building sustainable, inclusive financial structures across the continent. I am also a lover of nail beauty which led me to launch my own nail beauty brand,’Onyyxbygaga’.

Can you take us through your career trajectory?

I began my career in banking, steadily building expertise in relationship management, correspondent banking, treasury operations, and structured finance. My transition into agri-business was in deliberate–there was a need driven by a desire to connect capital to real-sector growth, especially in agriculture and my experience and passion for execution came in handy.

At Moneda, I provided the much-needed support to the structuring and deployment of over $200million in capital across SMEs. At Moneda, I am building a value chain strategy that integrates farmer empowerment, trading, and processing. More recently, I am focused on establishing a fintech platform ‘Thamani’, designed to democratise investment access for everyday Nigerians home and abroad.

Who and who would you say have been most influential on your life and career?

I have drawn strength from several places such as my family, whose resilience and work ethics shaped my foundation and approach to work, my daughter, who reminds me of the world I want to help build, my mentor, Dr. Augustine Isiuwe and colleagues who gave me room to grow, challenge convention, and lead with empathy.

Spiritually, my faith grounds me. It has been a constant compass in moments of uncertainty; I am a Christian.

As a woman, what are the challenges you have encountered in the course of your professional journey and how did you tackle them?

I am aware that being a woman in finance and commodity trading-both male dominated spaces, comes with challenges such as underestimation. However, I have built myself not to attribute the reasons for my challenges to being a woman.

I am not particular about office politics as I firmly believe in letting my works how my capacity. However, If I do find myself in apposition where my gender poses a threat to my growth, I will speak up and challenge the bias. Overall, my goal is to master my craft.

Can you relate some memorable experiences that you’ve had in your career?

I have had many memorable experiences in my career; one of my standout moments was when I led a community-based empowerment scheme where we distributed fertilizer and inputs to two hundred small holder farmers in northern Nigeria. The scheme made a huge impact, it reassured farmers, provided relief, a promise of increased yields, and a sense of ownership and reaffirmed why I do what I do.

Another was securing and deploying funds for the local fabrication of two transportations and barges for an SME in Lagos, Nigeria, helping the SME scale its operations despite regulatory and cost headwinds. They were moments that reminded me that finance when done right is transformational.

As the Vice President, Liquidity, Commodities Global Markets, what does your work entail?

My role sits at the intersection of capital strategy, risk, and trade. I lead treasury structuring, manage liquidity positions across currencies, and trade finance. I also design and execute Moneda’s investment products from naira-and dollar- denominated papers to blended finance vehicles and fund management operations when Moneda Capital begins operations.

In what ways would you say you have been impacting and adding value to the firm?

I have been instrumental in repositioning Moneda’s liquidity and capital strategy, improving fundraising operations, and driving investments into critical sectors like agriculture, logistics, and infrastructure. I was also instrumental in Moneda Capital’s licensing journey in Mauritius. I also closed strategic investor conversations and executed fluid funding models that cater to the needs of investors.

What are the challenges you face in the discharge of your duties, and how have you been tackling them?

Challenges range from macroeconomic volatility-such as Nigeria’s unstable FX and interest rate environment to the complexity of aligning investor appetite with on-ground realities. Internally, I have learned the value of stepping away when a structure or strategy no longer serves purpose.

What are your goals for your department?

For Moneda – My core goal is making capital work smarter- not just harder. This means deepening our investment products, expanding access to more cost-efficient and industry targeted dollar capital.

For Moneda – my goal is to build Africa’s most agile and impactful agri-trading engine. We are scaling beyond just buying and selling – into processing, farmer empowerment, and structured commodity finance. My focus is on tightening operations, deepening market access, and unlocking value from farm to final sale. Every cycle must move faster, smarter, and more profitably.

What advise do you have for aspiring female professionals in Nigeria?

I wish to advise aspiring female professionals to be confident in their abilities and remain steadfast even in doubtful moments when the urge to walk away might arise. Take some time to breathe, speak to your mentor, speak to God, and speak to yourself and move on to owning your space.

Do not shrink yourself to conform to anyone’s perception, invest in learning, build your confidence in silence and let your works peak for you but also learn to speak up for yourself.

Build a tribe and please ask for help. Say no when necessary and above all, choose purpose. If your ‘why’ is clear, every barrier becomes a stepping stone. Learn to understand times and seasons and always stay positive.