A judge of the High Court of England and Wales, Justice Butcher, has ordered the appointment of receivers over oil revenues due to Eroton Exploration and Production Company Limited in a bid to enforce a multimillion-dollar judgment obtained by Brightwaters Energy Limited.

In a detailed ruling dated 17 February, Justice Butcher granted Brightwaters’ application for a receivership order by way of equitable execution, finding it “just and convenient” in the circumstances.

Brightwaters and Eroton are both Nigerian companies, and the dispute arose from services and materials supplied by Brightwaters to Eroton in Nigeria.

On 21 June 2022, a consent judgment was entered at the High Court in Lagos, under which Eroton and Energy Link Infrastructure Ltd (ELI) were jointly and severally liable to pay Brightwaters $25,152,608. Partial payments totalling $3.5 million were made, leaving a substantial outstanding balance, the ruling noted.

In November 2025, the Nigerian judgment was registered in the King’s Bench Division of the English High Court under section 9 of the Administration of Justice Act 1920.

The court recorded that $16,652,608 remained outstanding, with post-judgment interest accruing at eight per cent per annum.

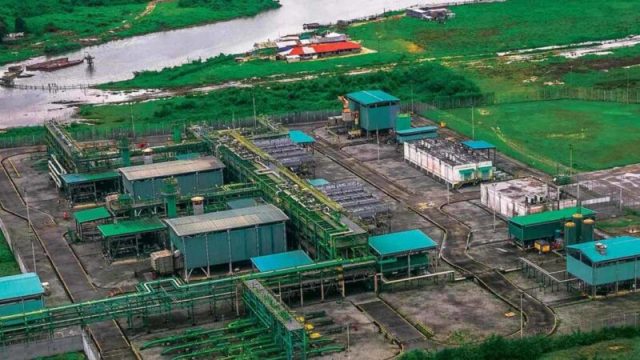

Brightwaters subsequently sought the appointment of receivers over oil revenues said to be payable to Eroton under a contract for the export of 32,000 barrels of oil per day from OML 18, a Nigerian oilfield in which Eroton has an interest. The court was prepared to infer that the relevant contract was governed by English law and provided for arbitration seated in England.

Asset Preservation

At an earlier, without-notice hearing in November 2025, the court made an Asset Preservation and Disclosure Order (APDO), requiring Eroton to provide detailed information about its oil revenues and prohibiting it from dissipating those funds.

Eroton failed to comply fully with the disclosure requirements, the document showed. Although some financial data was later provided, the judge found that it amounted to only partial and insufficient compliance.

In determining whether to appoint receivers, the court relied on established principles set out in cases including Cruz City 1 Mauritius Holdings v Unitech Ltd (No. 2) and Masri v Consolidated Contractors International (UK) Ltd (No. 2).

The court emphasised that the overriding consideration is the “demands of justice” and that there must be some hindrance or difficulty in using normal enforcement methods. A receiver will not be appointed if the exercise would be fruitless; however, it is sufficient if there is a real prospect that the appointment will assist enforcement.

Eroton’s objections

Eroton advanced five principal objections, all of which were rejected.

Eroton argued that the oil revenues were subject to security in favour of Guaranty Trust Bank plc (GT Bank), including an all-assets debenture and a subsequent charge, and that any receivership would therefore be ineffective.

The court held that even if the security arrangements amounted to an assignment by way of security, Eroton retained an equity of redemption — itself a valuable asset capable of supporting a receivership order.

The judge further found that there was at least a reasonable prospect that the appointment of receivers could assist enforcement, even if subject to GT Bank’s prior rights.

Eroton contended that Brightwaters, having commenced winding-up proceedings in Nigeria, should not pursue enforcement in England.

The judge described this as an “unattractive submission,” noting that Eroton had itself resisted and delayed those insolvency proceedings. He held that presenting a winding-up petition did not amount to an irrevocable election barring other enforcement methods in other jurisdictions.

Eroton argued that there was insufficient connection with England to justify the order.

But the court disagreed, noting that the Nigerian judgment had been registered as an English judgment and the relevant oil sale contract appeared to be governed by English law.

These factors, the judge held, provided sufficient connection and satisfied principles of comity.

Notice to GT Bank

Eroton argued that GT Bank should have been notified before any receivership order was made. The judge found that there is no procedural requirement under CPR Part 69 to give notice to secured creditors.

However, the order will allow GT Bank and other third parties to apply to vary or set it aside if they are affected.

Finally, Eroton alleged that Brightwaters breached its duty of full and frank disclosure at the earlier without-notice hearing by failing to refer specifically to registered charges in favour of GT Bank.

While the judge said it would have been preferable to refer expressly to the charges, he concluded that the omission was not material and did not mislead the court. In any event, the present decision followed a fully contested inter partes hearing.

Judgement

Considering all the circumstances, the court found that the outstanding debt is substantial and that payment has been difficult to secure through ordinary enforcement methods.

It was also established that there is a defined asset — oil revenues due and to become due — and that there is a reasonable prospect that receivership will assist enforcement without prejudicing third parties’ proprietary rights.

Accordingly, the court ordered the appointment of receivers over the oil revenues due to Eroton.

The judge said the order would promote the policy of English law that judgments — including registered foreign judgments — should be complied with and, if necessary, enforced.