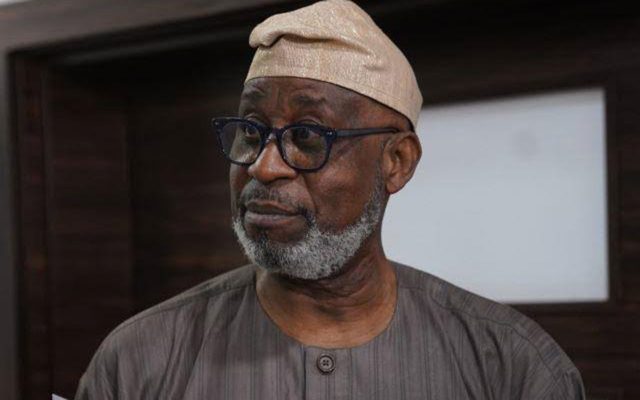

Minister of Solid Minerals Development, Dr Oladele Alake, yesterday, stated that the country’s capital market holds the key to unlocking the full potential of its vast mineral wealth.

He stressed that the capital market could mobilise long-term financing for exploration, project development, securitisation of geological assets, and listing of junior mining companies.

Represented by his Senior Adviser on Mining and Policy, Amira Adamu Waziri, the minister made the disclosure during a webinar, jointly organised by NASD Plc and the Solid Minerals Development Fund (SMDF), themed: “Unlocking Nigeria’s Solid Minerals Potential Through the Capital Market.”

Alake said the theme aligned with the ministry’s vision of building a sustainable, investment-driven mining sector capable of serving as a foundation for the nation’s economic transformation.

He said: “Nigeria is blessed with an extraordinary endowment of solid mineral resources, over 44 commercially viable minerals, ranging from gold and lithium to tin, lead-zinc, barite, and rare earth elements. These resources are spread across the country’s six geopolitical zones, positioning mining as a truly national sector.

“Yet, despite this wealth, the sector currently contributes less than one per cent to national GDP. The reasons are well known: insufficient geological data, weak infrastructure, informal operations, illegal mining, and a significant financing gap.”

“It is this financing gap that today’s conversation seeks to address by exploring how Nigeria’s capital market can serve as a channel for patient, long-term, and strategic investment in the solid minerals value chain.”

The minister reiterated that the most populous black nation stands at the threshold of a mining renaissance, adding: “We have the mineral resources, and we have the political will. What we now require is the capital, technology, and partnerships to unlock this potential. Mining is not just about extracting minerals; it is about building an inclusive, resilient, and globally competitive economy.”

In his remarks, Director-General of the Mining Cadastre Office (MCO), Obadiah Nkom, outlined licensing processes, stressing that reconnaissance permits ensure environmentally cautious entry into mining areas.

He said investors must comply with reporting obligations, periodic progress reports and payment of yearly service fees to retain permits.

Executive Secretary of SMDF, Fatima Umaru Shinkafi, represented by Omotayo Omitokun, explained that the event shed light on critical aspects of the mining asset development cycle.

She commended experts, who made presentations, stating: “We believe that the insights gained today will not only shape investment readiness, but also accelerate sustainable growth and value creation in our mining industry through the capital market.”

Also speaking, Director at Agile Dynamics, Paul Lalovich, proposed “real-world asset tokenisation” as a mechanism to unlock early-stage exploration funding.